Grid Switch

Access the Money Grid

using domestic real-time rails

Scale faster with Lightspark

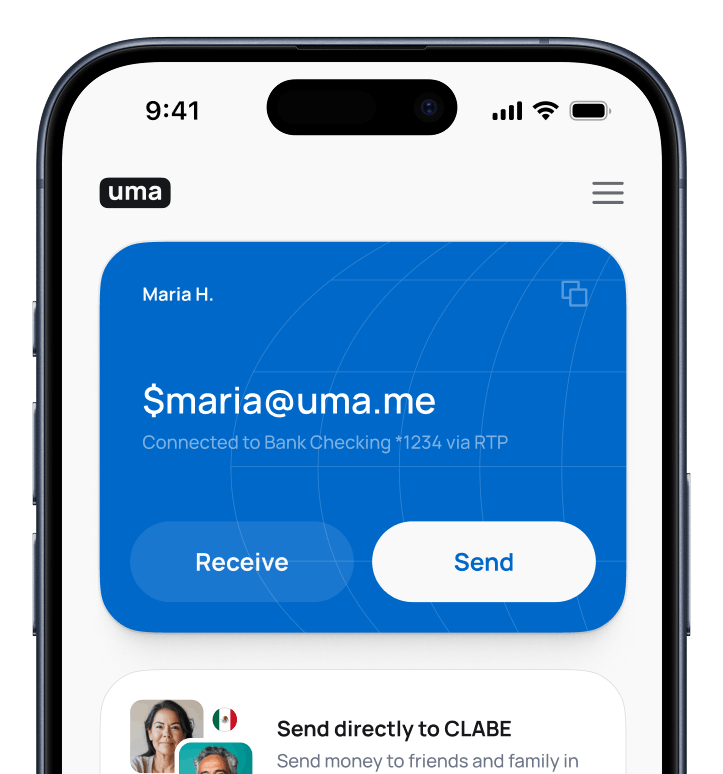

Digital banks and wallets use Grid Switch to access the Money Grid using domestic real-time payment systems, enabling instant, cheap, and global money transfers.

Enter new markets fast. Add corridors without overhead, no new licenses, no new infra.

Any amount, at scale. From micro-payments to millions.

Built-in compliance. Including travel rule, and OFAC screening.

Developer-ready. Intuitive APIs, SDKs, and docs designed to reduce lift and accelerate integration.

Real-time. Transaction speeds with

final settlement in seconds.

Expand reach. Compete with global players—even with a lean team.

How it works

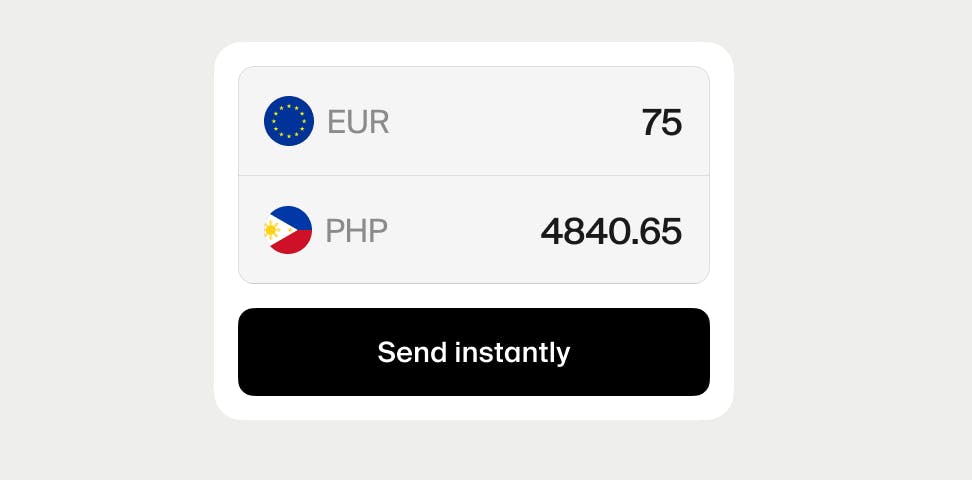

Sender initiates a transfer in Euros (EUR) from a European bank account.

Funds are instantly pulled via SEPA.

The funds are converted from EUR to BTC via the [EUR Switch].

BTC is sent over The Money Grid via the Lightning Network, being used as a neutral settlement asset.

The funds are converted from Bitcoin to Philippine pesos (PHP) via the [PHP Switch].

Funds are instantly pushed to the receiver Philippine bank account via InstaPay.

Endpoints

Wallets

Custodial wallets

Self-custody wallets

Mobile wallets

Hardware wallets

Lightning-native wallets

Banks

Digital banks

Traditional banks

Exchanges

Centralized exchanges (CEXs)

Decentralized exchanges (DEXs)

On/off-ramp providers

Liquidity providers

Businesses

Merchant platforms

B2B marketplaces

P2P marketplaces

Payout endpoints

Embedded finance platforms

SaaS billing systems

Consumers

Global remittance users

Gig economy workers

Freelancers / cross-border earners

Crypto-native users

Grid Switch countries

Asia

Bahrain

البحرين

Botswana

Cameroun

République Centrafricaine

Côte d'Ivoire

Egypt

مصر

Guinea-Bissau

Guinée

Guinée Equatoriale

India

Israel

Jordan

الأردن

Kenya

Kuwait

الكويت

Madagascar

Mali

Maroc

Maurice

Mozambique

Niger

Nigeria

Oman

عُمان

Qatar

قطر

المملكة العربية السعودية

Sénégal

South Africa

Tunisie

Uganda

United Arab Emirates

الإمارات العربية المتحدة

North America

Canada (English)

Canada (Français)

Puerto Rico (English)

United States

Asia Pacific

Australia

中国大陆

Hong Kong

香港

Indonesia

日本

대한민국

澳門

Malaysia

New Zealand

Philippines

Singapore

台灣

ไทย

Việt Nam

Europe

Armenia

Azerbaijan

België

Belgique

България

Česko

Danmark

Deutschland

Eesti

España

France

Georgia

Ελλάδα

Hrvatska

Ireland

Italia

Kazakhstan

Kyrgyzstan

Latvija

Liechtenstein

Lietuva

Luxembourg

Magyarország

Malta

Moldova

Montenegro

Nederland

North Macedonia

Norge

Österreich

Polska

Portugal

România

Россия

Slovensko

Slovenia

Schweiz

Suisse

Suomi

Sverige

Tajikistan

Türkiye

Turkmenistan

United Kingdom

Україна

Uzbekistan

South America

Anguilla

Antigua & Barbuda

Argentina

Barbados

Belize

Bermuda

Bolivia

Brasil

British Virgin Islands

Cayman Islands

Chile

Colombia

Costa Rica

Dominica

República Dominicana

Ecuador

El Salvador

Grenada

Guatemala

Guyana

Honduras

Jamaica

México

Montserrat

Nicaragua

Panamá

Paraguay

Perú

St. Kitts & Nevis

St. Lucia

St. Vincent & The Grenadines

Suriname

The Bahamas

Trinidad & Tobago

Turks & Caicos

Uruguay

Venezuela

Compatible domestic payment networks

Africa

Asia

Asia Pacific

Europe

North America

South America

Grid Switch uses Universal Money Address (UMA) — the open protocol powering cross-border transactions. UMA enables 24/7, low-cost global payments using just an address, built for compliance and designed to scale.

The partnership with Lightspark, which has developed an excellent technical solution is another step in Nubank’s mission to provide the best solutions for our customers and reinforce our long-term relationship with all of them. Thomaz Fortes, ED, Nubank Crypto